30+ 7 year arm mortgage calculator

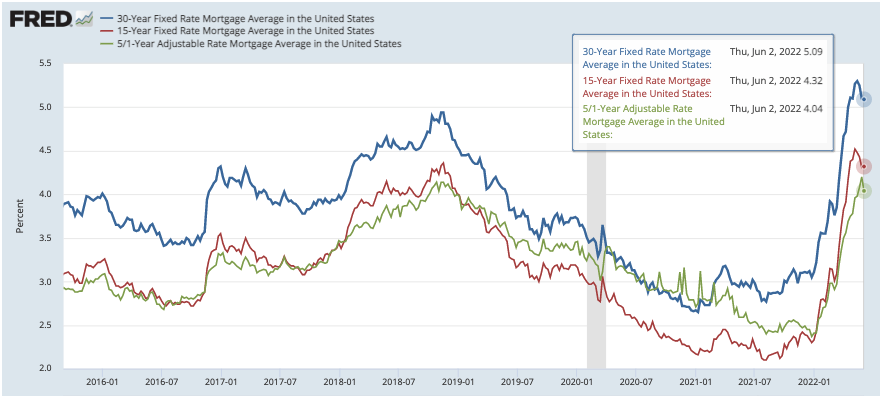

Adjustable-rate mortgage products have only been around since the 1980s. Thanks to Freddie Mac theres solid data available for 30-year fixed-rate mortgage rates beginning in 1971.

Advanced Mortgage Payoff Calculator R Daveramsey

Current 3-Year Hybrid ARM Rates.

. A 31 ARM used to be a type of 3-year adjustable-rate mortgage where the interest rate was fixed for the first 3 years and then adjusted annually for the remainder of its term. The average APR on a 15-year fixed-rate mortgage remained at 4951 and the average APR for a 5-year adjustable-rate mortgage ARM fell 1 basis point to 5305 according to rates provided to. By default refinance loans are displayed.

They briefly dipped down into the mid- to high-8 range before climbing to 1120 in 1979. The now retired 71 ARM loans were based on a benchmark known as LIBOR London Inter-Bank Offered Rate that will cease to be published by 2023. Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3.

FHA 30-year fixed - Best for homebuyers with lower credit scores. Find and compare 30-year mortgage rates and choose your preferred lender. A 71 ARM used to be a type of 7-year adjustable-rate mortgage where the interest rate was fixed for the first 7 years and then adjusted annually for the remainder of its term.

Historical 71 ARM Rates. The following table shows the rates for ARM loans which reset after the third year. As of 2019 71 ARM mortgage rates were around 378 on average.

Fixed-rate mortgage interest rate and annual. Rates in 1971 were in the mid-7 range and they moved up steadily until they were at 919 in 1974. Compare the latest rates loans payments and fees for 30 Year Fixed mortgages.

5130 4550 4390. VA loan - 30-year fixed-rate for qualifying veterans and active military. 30-year fixed rate mortgages and interest.

5550 4850 4360 0818. Mortgage loan calculator. Bankrates mortgage amortization calculator shows how even a 01 percent difference on your rate can.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 5 7 or 10 years. On the contrary the average mortgage rate for 71 ARMs was around 3 in 2015 and 2016.

Lets take a closer look at interest and how it plays into 30-year mortgage rates. Also a great option if you want to put down a smaller down payment. Meanwhile the current average rate for the benchmark 30-year fixed mortgage is 595.

The now retired 31 ARM loans were based on a benchmark known as LIBOR London Inter-Bank Offered Rate that will cease to be published by 2023. 51 ARM - Similar to the 71 ARM but the interest rate can change after 5 years. While researching 30-year fixed mortgage rates youll notice that the loans interest weighs heavily on your borrowing limits and repayment minimums.

Rates have generally fallen from 2020 to 2022 though. See todays mortgage rates and get the best refinance mortgage rates or purchase mortgage rates by comparing mortgage rates for 30 year fixed 15 year fixed 51 ARMs and more. Name of lender or broker contact information.

Home Loans St Louis Real Estate News

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Mortgages What Is The Purpose Of Amortization Quora

Best 10 Mortgage Calculator Apps Last Updated September 2 2022

Best 10 Mortgage Calculator Apps Last Updated September 2 2022

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

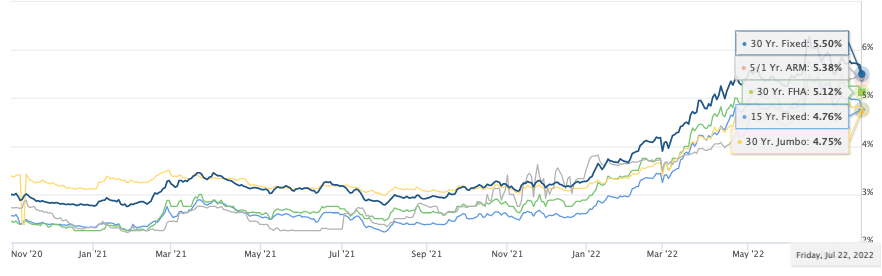

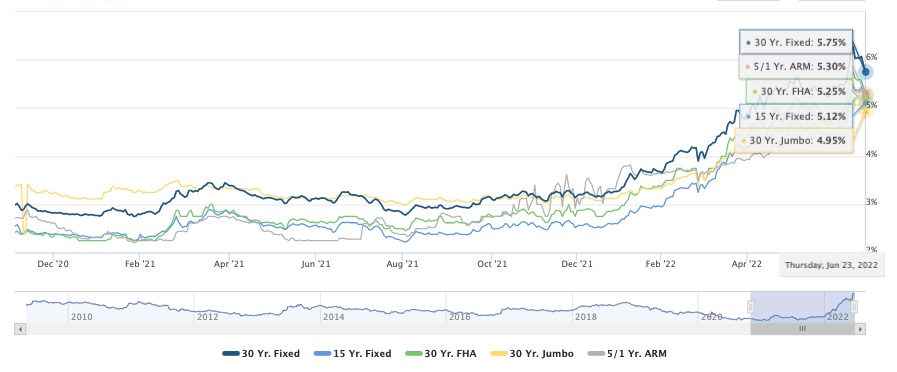

St Louis Interest Rates St Louis Real Estate News

St Louis Interest Rates St Louis Real Estate News

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

St Louis Interest Rates St Louis Real Estate News

Your Adjustable Rate Mortgage Needs To Be Refinanced

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

Pin On म र स व क ए गए

St Louis Interest Rates St Louis Real Estate News